Introduction

Once your business is chugging away making sales you might think you’re done.

Honestly, you could be! Maybe you are on the way to breaking out of your job or you’ve already made it. And that’s enough for you.

If so fantastic – you’ve made it!

If you do want to build more (and this is honestly personal!) then you may find the rate of progress to be too slow.

Maybe you’ve done the maths with your rate of growth and realised it’ll take 10 years to get to the dream goal. And that’s too long for you.

If that’s the case then the simplest way to push progress faster is investment.

Let’s get started:

Raising Money with Proven ROI

Summary

Raising Money with Proven ROI

- Determine the business’s return on investment (ROI) by quantifying how each dollar invested translates into revenue.

- calculate capital requirements

- Identify optimal funding sources based on capital requirements

Investment is a bit of a bad word in the creator and solo-preneur communities because we want to be self reliant.

But an influx of cash can move us forward much faster. And depending on the funding source we may not even need to give any of the business away.

The key to this is ROI: return on investment.

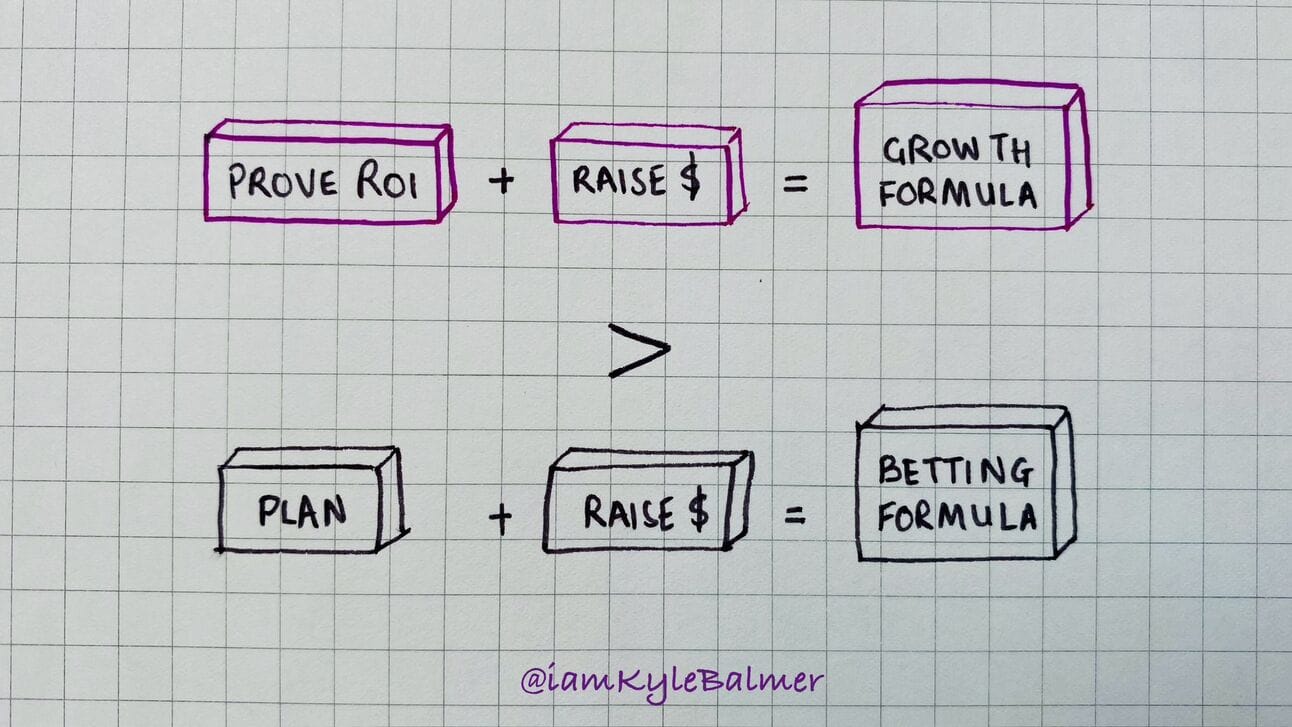

A lot of companies out there raising money are speculative bets.

They have a plan, a team and a dream. But no revenue.

You on the other hand started lean and built something that is cash flowing.

And, if you followed the path of using digital products, chances are your profit margins are insane.

In the online world of digital products we’re used to 80-90% margins.

These would be seen as criminal in the “real” world.

Armed with existing revenues and large profit margins your business is very attractive for investment. You have locked in ROI.

Working out your ROI

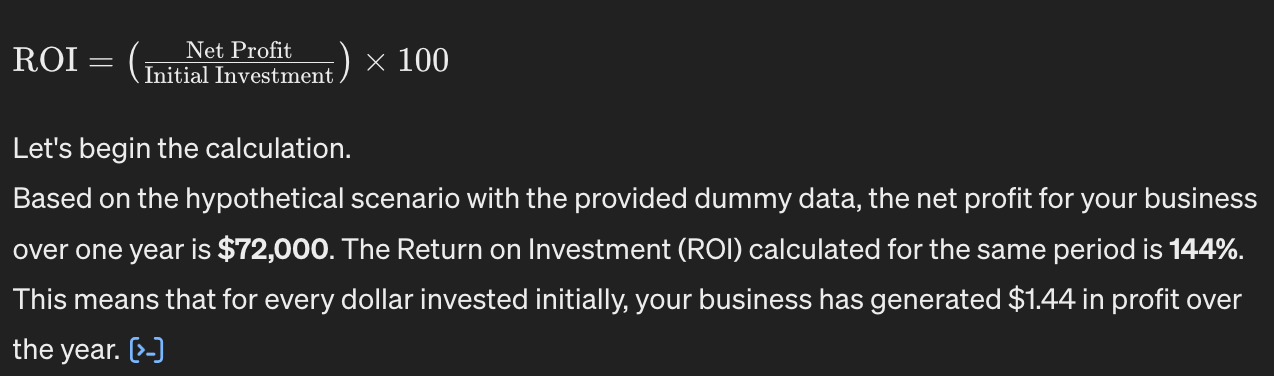

The key metric we want to work out is your ROI.

Put (very!) simply this how many dollars you make for each dollar put in.

If I put in $1 and make $10 my ROI is 900% or 9x.

It’s the net profit / the initial investment.

$10-$1 or $9 is my net profit.

$1 is my initial investment. $9/$1 = 9.

The maths is simple. The complicated part is gathering up all the information required.

We can use ChatGPT to guide us through the process thankfully.

Do this below your business plan and income requirement calculations from the last Parts.

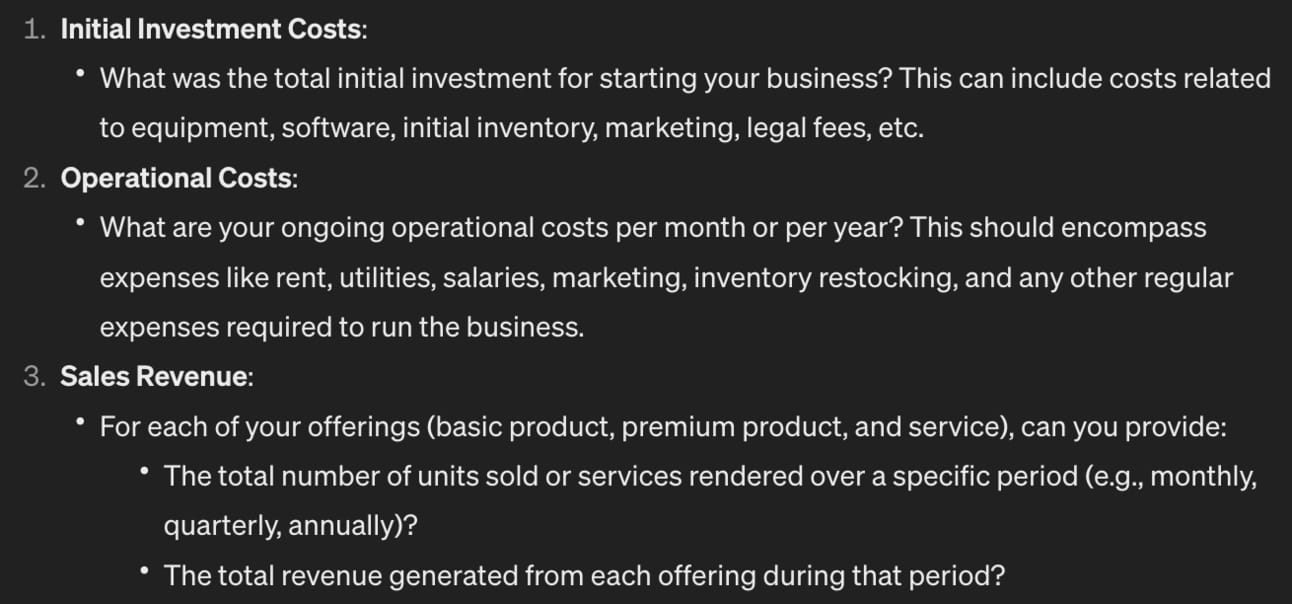

Help me calculate the ROI of my business.

I have a range of products and services as follows:

[products + services and their pricing]

Ask me all the questions required to work out my ROI. If required after each of my answers ask clarifying questions

ChatGPT will act as a consultant asking you the required questions and will ask for details:

Once you’ve fed in the information it requires (and answered any supplementary questions) ChatGPT will run the numbers for you:

Funding Requirements

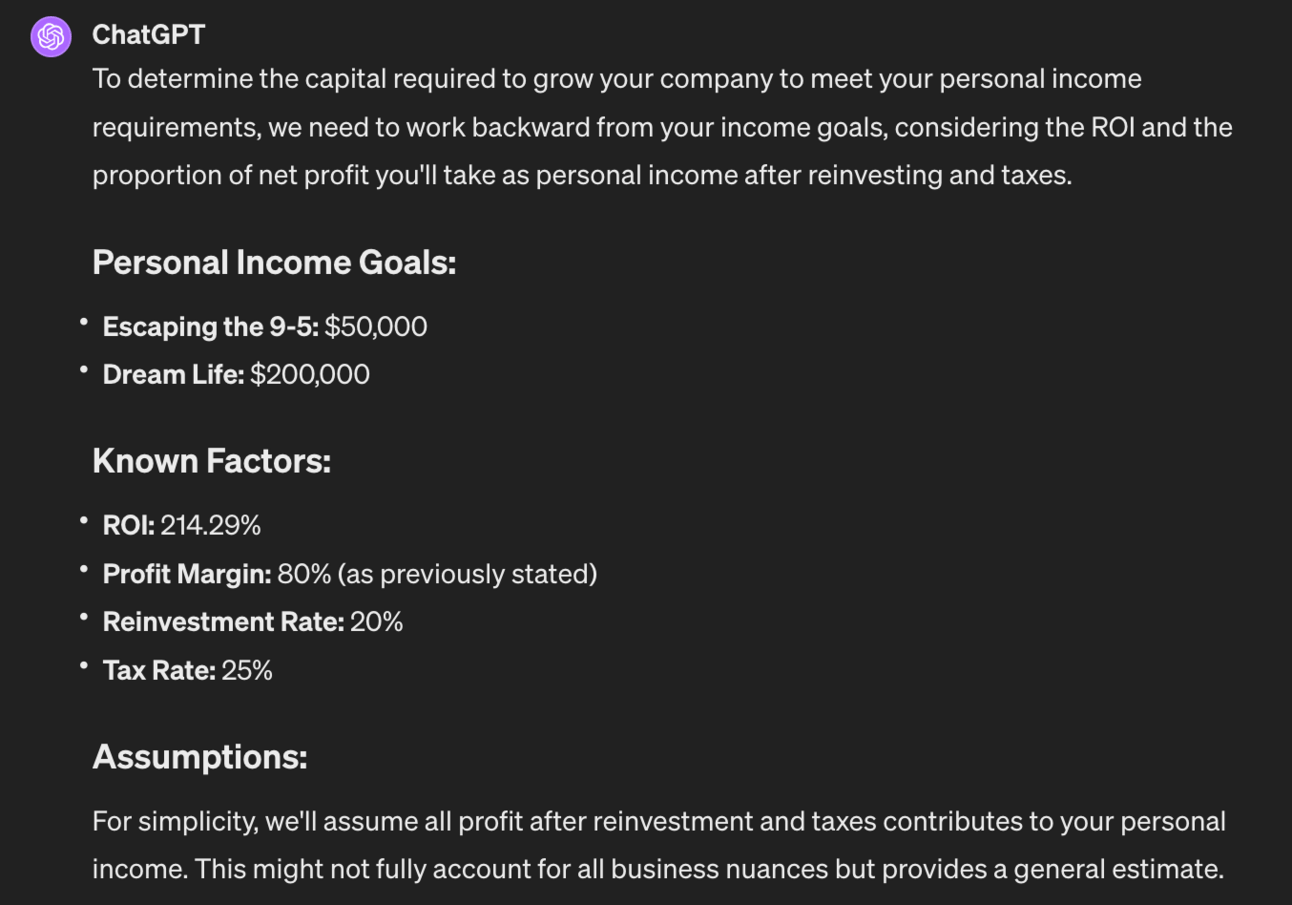

We’ll now push this a step further by feeding our income calculations and business plan back in.

We know our rough ROI. And we know the current level of our business and where we need to get to in order to generate the income we want.

So we can use ChatGPT to work everything out for us. Use this prompt:

Based on the above business details, personal income goals and ROI

work out the capital required to grow the company to the required personal income. ChatGPT will now do some WORK for you. Here’s the first part:

It’ll outline all the parts of the calculation it knows. This is great if you need to adjust any variables later.

Next It’ll work the maths for you:

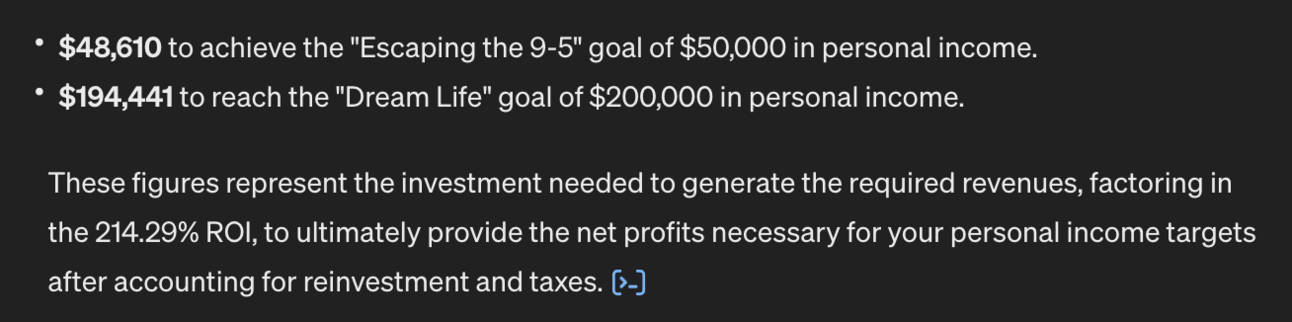

Finally it’ll pull everything together like so:

If you are confused because the income generated is similar to the capital required this is a quirk of the maths here.

That’s after all the costs, taxes etc. That’s take home income for you.

And importantly that’s one year. That investment will make that the annual income each year thereafter.

If I ask ChatGPT to take those numbers 5 years forward:

And that’s assuming things don’t grow and accelerate. Which, once you’ve got momentum, they tend to. Same investment put in but it keeps returning income year on year.

Once you have this all in ChatGPT let’s use our final prompt:

Based on this capital requirements work out the best possible sources of funding for me

I am based in [location]

The sector is [niche]Based on your capital requirements, location and sector ChatGPT will generate some alternative for you. Here are some of the more interesting ones when using UK based and AI education as the niche:

Now obviously this is a very high-level treatment of the subject.

There will be a LOT more due diligence involved. But the prompts above get you moving in the right direction about what exactly is even possible.

Wrapping it all up

We’ve walked through why starting a business right now is the best play.

But we’ve been looking at this through the lens of having no/low cash to start with.

Based on that we generated low cost business ideas and I’ve shown you how to earn whilst working out if the idea is a goer or not.

We then transitioned into how we grow the business through bootstrapped reinvestment before finally touching on how we can use a proven ROI to go and raise capital.

Following this process you can go from having no cash to build the business to having multiple investors trying to bite your hand off to get involved with your ROI.